Carleton offers two group health insurance plans. Participation is voluntary, the premiums are shared between Carleton and the employee, and are deducted on a pre-tax basis.

Health Partners is the insurance provider for both the Blue and Maize plans. Both plans offer the following coverage:

- Preventative services are covered at 100%,

- In-network and Out-of-Network coverage.

- Domestic partner coverage.

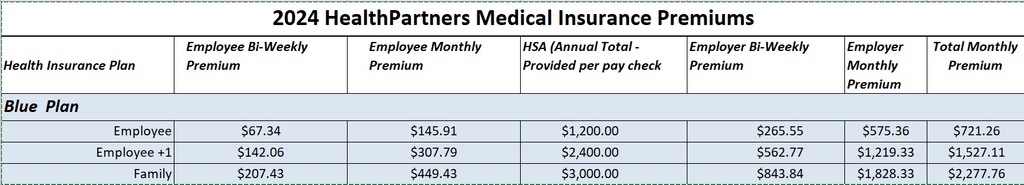

Blue Plan – High Deductible Health Plan (HDHP)

The Blue Plan is a High Deductible Health Plan (HDHP), which offers preventative and catastrophic coverage with an employer-funded health savings account (HSA). Prescriptions drugs are covered after your deductible has been met, however there are some preventative medications that have a co-pay.

- Employees nearing age 65 need to notify Human Resources when enrolling in Social Security or Medicare as there are implications to your ability to make and receive contributions to your HSA plan.

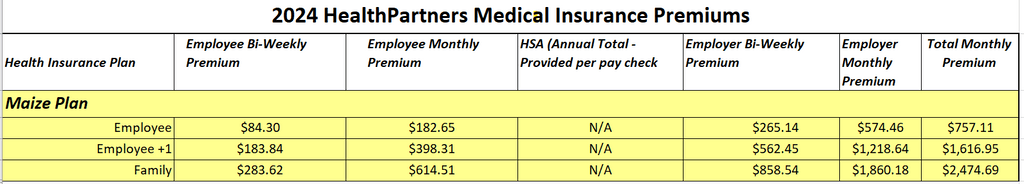

Maize Plan – Copay and Deductible

The Maize Plan has a copay for office visits and a deductible for other types of care. You may participate in a Flexible Spending Account (FSA) if you enroll in the Maize plan.

COVID-19 & Health Insurance

- COVID-19 Coverage for testing and treatment varies by plan.

- Effective through the end of the national public health emergency, Carleton’s health insurance covers the COVID-19 screening test at no cost to plan participants.

- Additional treatment or antibody testing will be treated like any other health condition, which are subject to plan co-pays, annual deductible, and annual out-of-pocket maximum.

- COVID-19 medical expenses are eligible for FSA and HSA reimbursement.

- Members will have access to the same network of providers, although not all providers offer COVID-19 testing and treatment.

- If you are covered by another plan, you can contact your provider for information regarding your coverage.

- Contact Human Resources (hr@carleton.edu) or HealthPartners with questions.

Virtuwell

HealthPartners Virtuwell online clinic, available 24/7: beginning in 2024, both the Blue and Maize plans provide coverage at 100%. Visit them online or call them at 877-440-1001.

Life Qualifying Event

If you experience a qualifying life event as defined by the IRS, you need to contact Human Resources. You have 31 days from the effective date of the event to make changes by adding or dropping benefits.